Structured settlement annuity rates continue to improve! Don't let your clients risk their hard earned settlements in the high risk stock market!

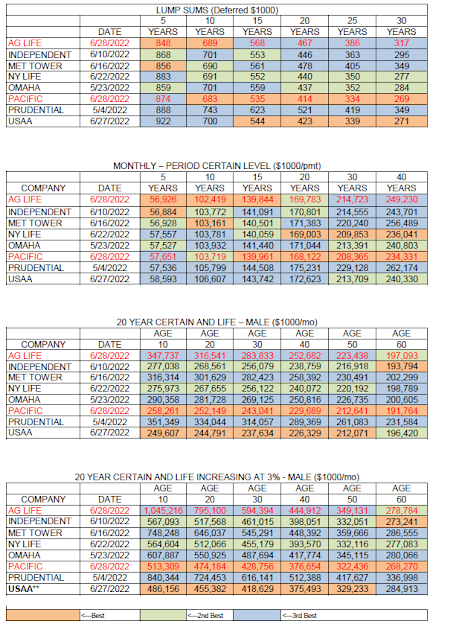

Here are the latest structured settlement annuity rates.

For OVER 20 YEARS we have been Michigan's PREMIER and ONLY PLAINTIFF FOCUSED STRUCTURED SETTLEMENT CONSULTANT!

Please contact us at (734) 433-1670 or cyril@whitehousellc.com and let us help you and your clients maximize your hard earned settlement dollars!

Comments